Steps to create SBI Saving account online-

Account opening form can be filled at your convenience and fields can be checked for errors.

Time taken for opening of the account will get reduced as the data already be available in the system.

- First you need to open the following website https://oaa.onlinesbi.com/oao/onlineaccapp.htm

- Now after opening the web site you have to click on the START NOW option (Last one).

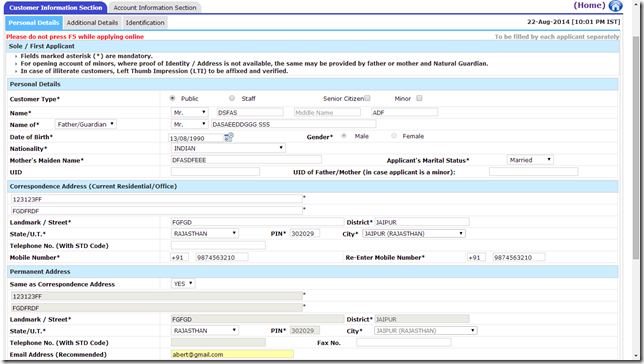

- After clicking on the START NOW option fill the Personal Details like customer type (in our case it is public), name, name of Guardian, Date of birth, Nationality, mother's name, Address, phone number.

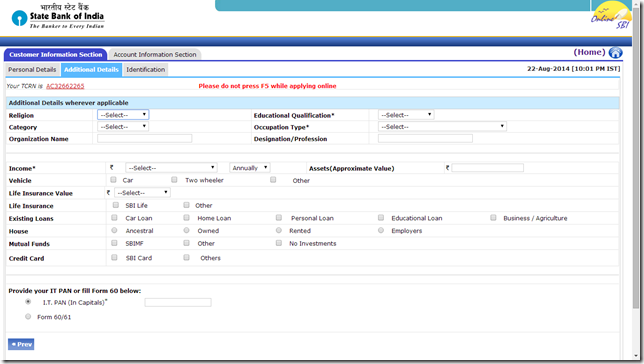

- After clicking on submit button, system generate an TCRN No (Temp Customer Reference No.) eg. AC32662265, which is valid for 30 days.

- Now save and proceed to the next step which is additional details like Religion Educational Qualification occupational Type and etc its looks like this.

- Now in the Next step you have to submit document details for address proof

- And the next part is about choosing additional services like Internet Banking, Mobile banking, SMS alerts -

- After submitting the whole form you have been provided with a Unique no,visit your bank where you want to open this account just tell them this no and you don't have to fill piles of papers.